A question I’m often asked about my solar is, “how exactly does Net Metering work?” Here in the state of Washington, the rules for Net Metering are enshrined in RCW 80.60.030. Go forth and read, if you’re the nerdy type. For everyone else…

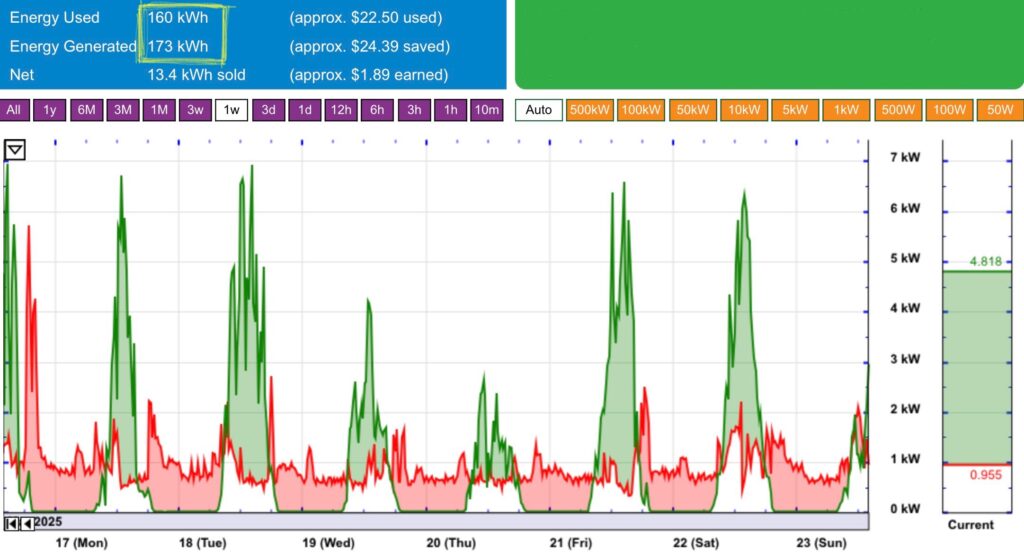

Every year on March 31, my Net Metering kWh balance resets to zero. When the sun shines I harvest kWh. I also run the heat pumps, toaster oven, and charge my phone and car, all of which consume kWh. If I consume more than I produce, I pay my utility (Seattle City Light) for the kWh they provide, just as everyone else does. If I produce more kWh than my house and car consume, then SCL adds those surplus kWh to my Net Metering balance.

In practice, each year in April I produce as much energy as I consume. From May to September I generate surpluses and build up kWh credits. As winter progresses my solar production falls off and I start depleting the kWh credits. In most years, I exhaust my credits by January and have to start buying kWh.

On March 31st, if there’s any kWh credit balance, it gets wiped away as a free gift to SCL. Therefore, under net metering it rarely makes economic sense to produce any more kWh than one consumes.

My average consumption for the past couple years has been about 2,000 kWh more than I produce, resulting in bills of about $400 per year. That is why I just spent $900 on 6 new 405W solar panels to grow my array. With a rated capacity of 2,400 kWh, I expect them to produce about 2,000 kWh per year, getting me very very close to my target of Net Zero energy.